Here is the latest sales data for Q3. The general theme is that as inventory remains lower, home values have been holding steady. Read below for my insights into the data and click on the link for the full breakdown and other surrounding area data.

Click here for the full flip book -> Q3 Park City Stats

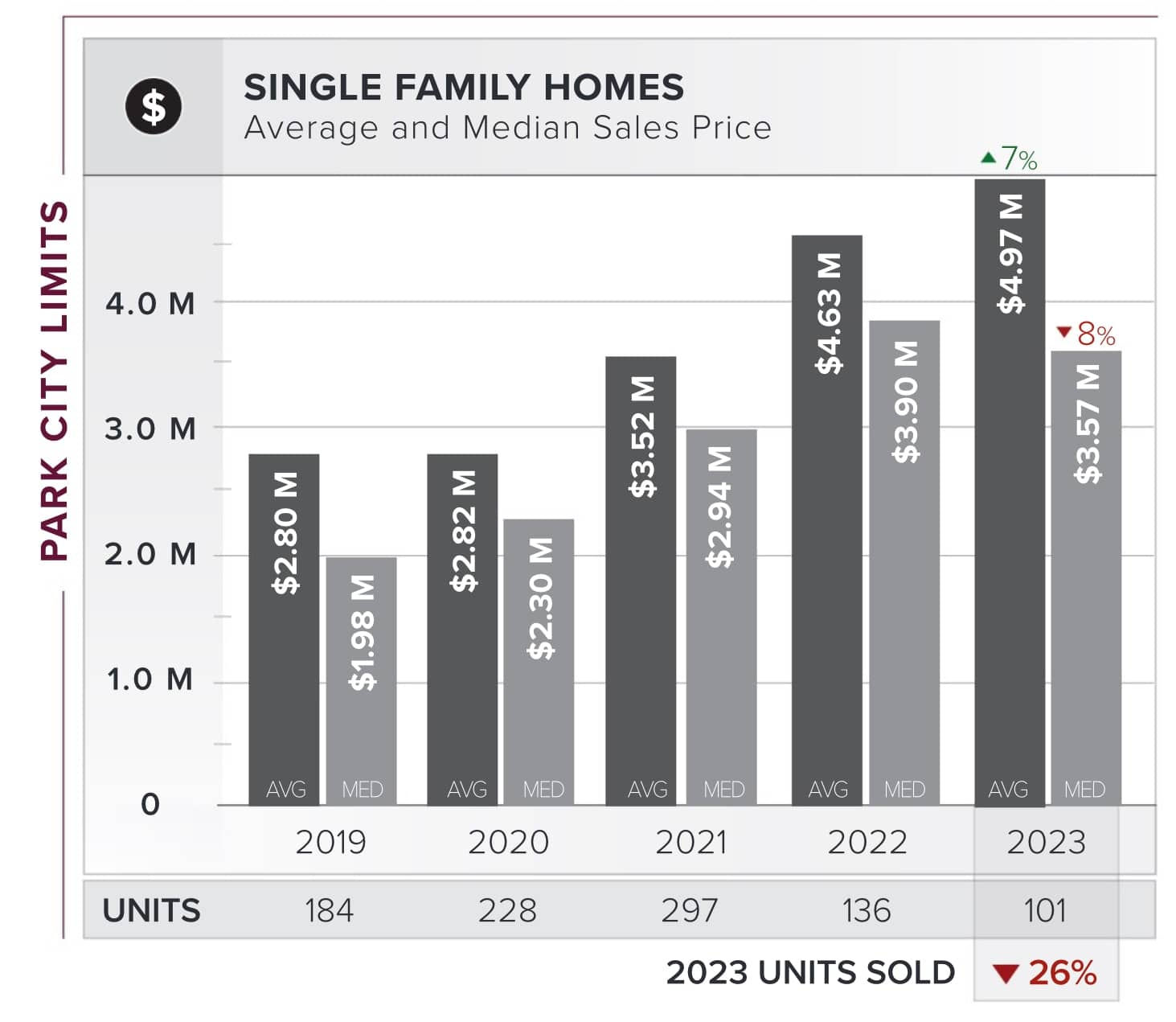

Starting with Park City Limits Single Family Homes which includes the areas from the White Barn into town and Deer Valley:

As we can see by the numbers, through Q3 2023, total units sold were down 25% vs the same period in 2022. That isn’t surprising as interest rates and the economy has slowed buyer demand a bit but we also aren’t seeing as many homes come on the market. The Average price was up 7% which shows that the high end market continues to be strong and continues to edge up year over year. The Median price is interesting because it illustrates what I’ve been telling clients over the past 6 months which is that prices over all remain stable with pockets of opportunity. With low inventory and lower buyer activity, motivated sellers have been reducing prices to get their homes sold quicker. As we enter Q4 it will be very interesting to revisit that Median price. I expect it to hold steady or start to increase again.

Moving on to Condo sales in the Park City Limits we see values increasing even with lower inventory. Sale volume is down 33% while values are up 10%. We have seen extremely low inventory around Deer Valley and Main St but these areas continue to be in high demand and therefore we continue to see a healthy year over year increase in values. This trend should continue as we move into the Winter Ski Season when we see an increase in buyer interest for Vacation Homes. The St Regis Phase 3 and Founders Place which are both new construction projects have seen strong interest as has Sommet Blanc.

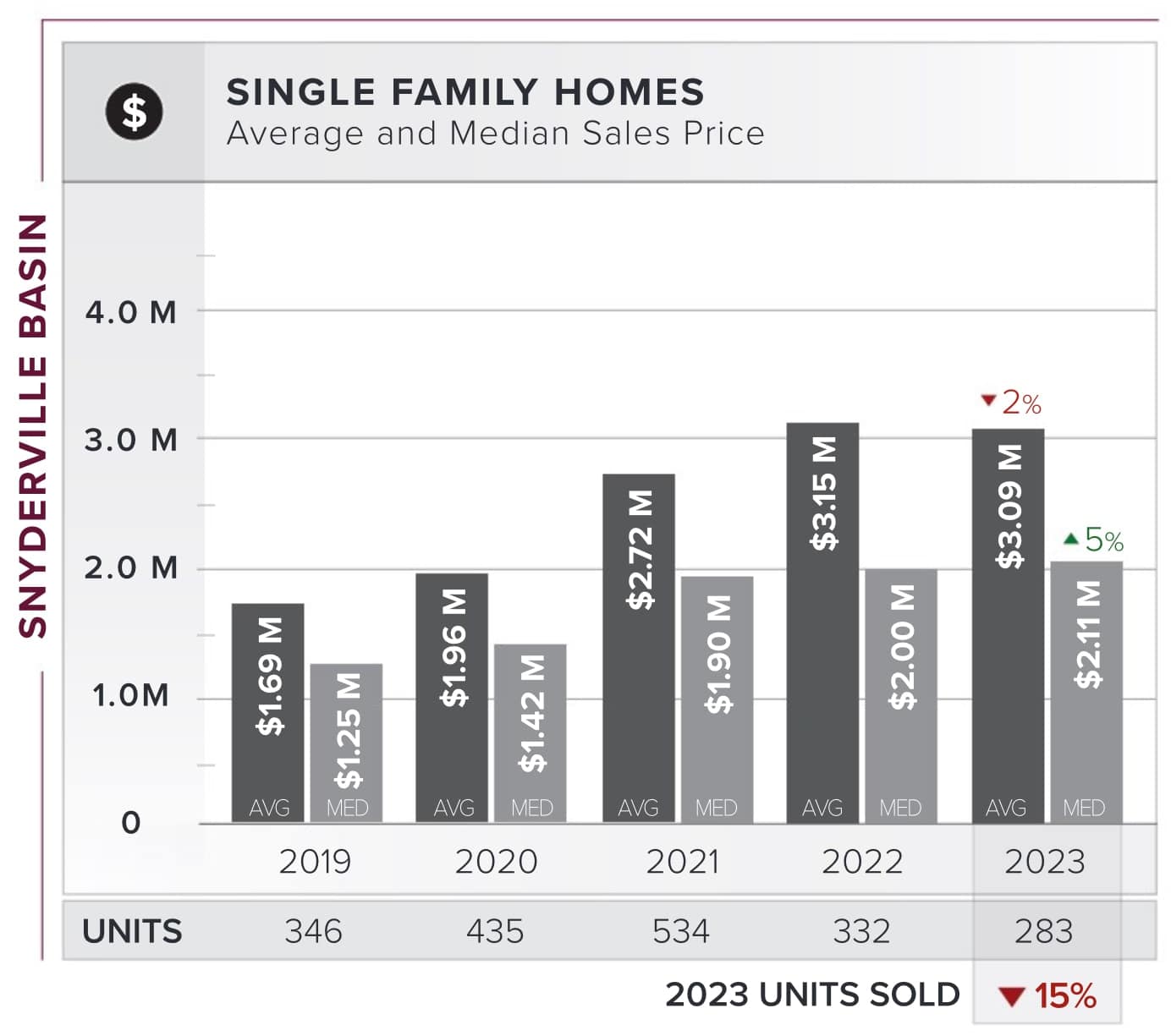

Moving over to Snyderville Basin which includes areas from the Canyons and Silver Springs out to Promontory and over to Summit Park:

Here we see the Single Family Home trend essentially flat with volume down 15%. With such a broad area included in this data it is hard to apply it to a particular neighborhood or development but these are encouraging numbers for both Buyers and Sellers. If you want to buy a property, a flat market is better than a falling market. Unfortunately for bottom-seekers, there isn’t a fire sale on properties. There is as I mentioned above, pockets of opportunity but we are really seeing a consolidation on prices similar to the chart of a stock that moves up quickly and then flattens out a bit as Buyer demand catches up.

Finally (for this post) we see the condo volume and values in the Snyderville Basin. Volume was down an incredible 50% but not far off the 2019 numbers. Again we see that consolidation trend with the Averages flat and the Median dropping a bit. This shows that there was more interest in the lower end with more value hunting. The 2021 numbers were an interesting anomaly with a lot of Yotel condos being sold dropping both the average and median down quite a bit.

If you are curious about a particular neighborhood or condo project please reach out for a more detailed valuation breakdown! Would love to hear your thoughts as well so give a call or send me an email.

Cheers, -Josh